Frequently Asked Questions

Quickly find out if we've already addressed questions that you might have.

- Banks (universal, commercial, thrift, and rural)

- Credit card companies

- Private leasing and financing companies

- Government-lending institutions (GSIS, SSS, and Pag-IBIG Fund)

- Cooperatives and cooperative banks

- Microfinance institutions

- Telecommunications companies

- Insurance companies and mutual benefit associations

- Utility companies (electricity, cable providers, etc.)

- Personal and/or business accounts

- Loan accounts

- Credit card accounts, installment, and/or non-installment contracts

- Be a Filipino citizen or resident.

- Be at least 18 years old.

- Be enrolled in an undergraduate or postgraduate degree and can present proper documentation of enrollment status

- Be enrolled in a CHED-accredited university or institution

Please note that the whole application process takes about 8 business days, provided that students are responsive and ready with their requirements. The loan is released after 2-4 business days upon successful booking of the loan.

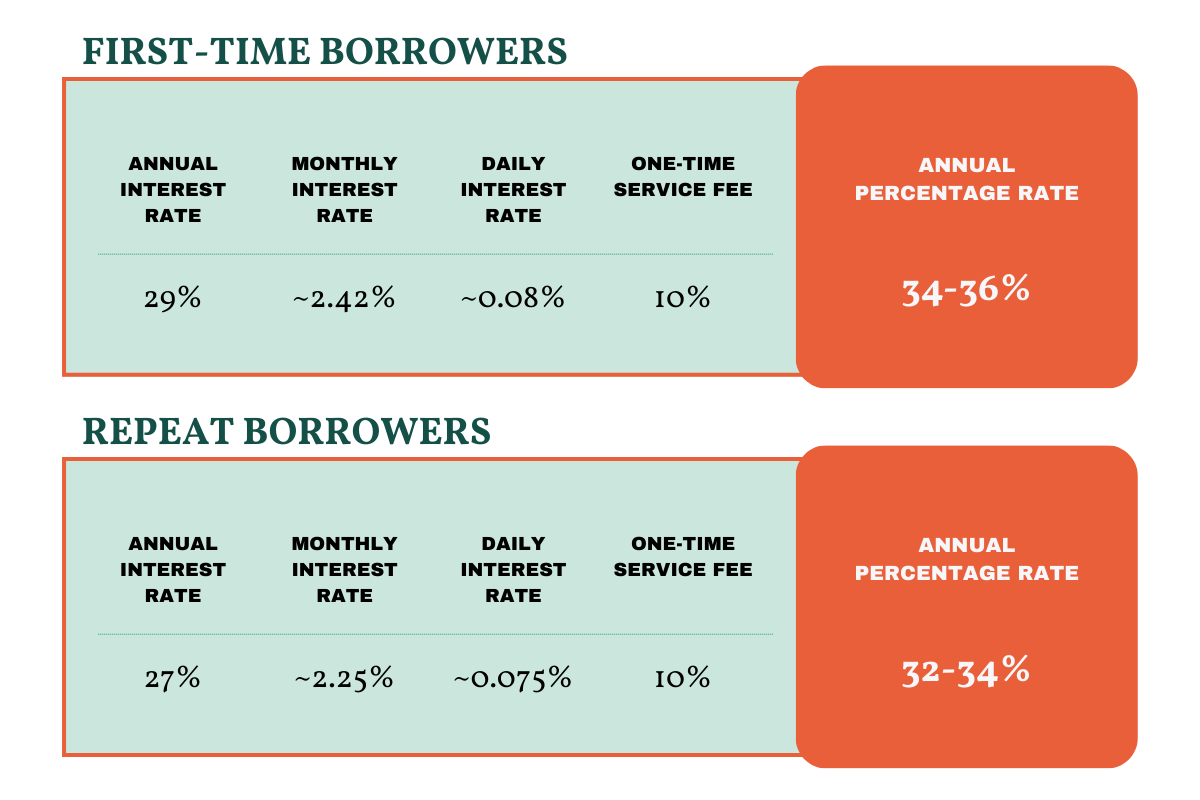

Once a part of the Investee community, you may apply for an additional or alumni loan and avail lower interest rates, a privilege extended to active Investees with good repayment record.

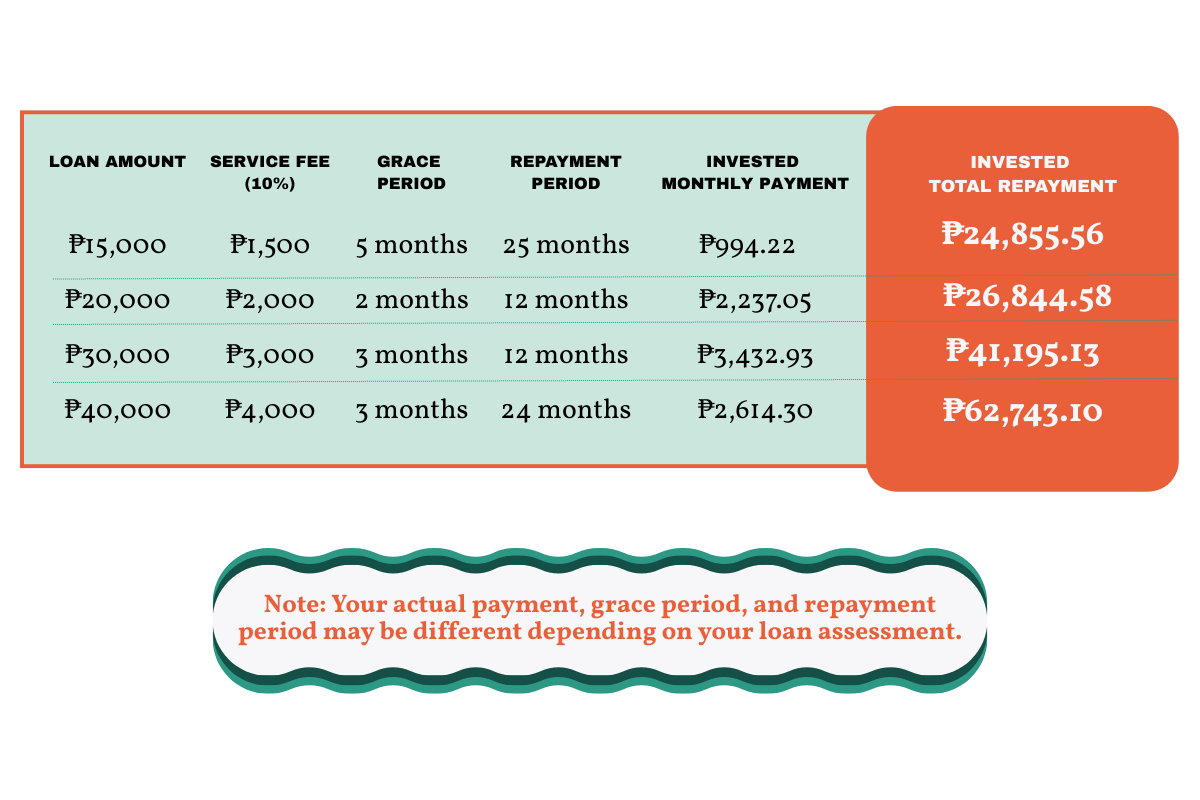

Note: The actual rate and repayment terms will be shown in full before you accept any loan offer

Additionally, a late payment fee of Php 500 will be charged, as stated in Section 6 of the InvestEd Loan Agreement, and you will be marked as delinquent, which will show in your payment record.

As part of our due diligence here in InvestEd, we ask student applicants for specific documentary requirements needed to process their application.

In the 5 easy application steps, there are two sets of requirements you need to complete. See below what you need to prepare for easier and smoother processing!

- Your Personal Identification - at least one of the following:

- Photo of School ID front & back; unexpired

- Primary Government ID PhilHealth, Pag-Ibig, or TIN ID are not accepted

- Primary IDs accepted: Passport, UMID Card, LTO Driver's License, PRC ID, Voter's ID, GSIS ID, and SSS ID

- Your old SHS ID is accepted, but it must be submitted along with your birth certificate

- NBI Clearance

- A selfie with your chosen Identification

- Your Proof of Enrollment - at least one of the following:

- Certificate of Enrollment

- Certificate of Registration

- Assessment Form

- Your Guarantor

- Contact Info - valid and working mobile number and email address

- Identification - at least one of the following:

- Company ID

- Primary Government ID PhilHealth, Pag-Ibig, or TIN ID are not accepted

- Primary IDs accepted: Passport, UMID Card, LTO Driver's License, PRC ID, Voter's ID, GSIS ID, and SSS ID

- NBI Clearance

- Guarantor's selfie with chosen Identification

- Occupation Details Guarantor must be living and working in the Philippines. He/she must not be over 59 years old within the duration of your loan terms. If married, he/she cannot be your spouse

- Facebook Account Link We need this to verify your Guarantor

Note: If applying for gadget/thesis/allowance/rent loan, POE must be from the current semester.

Necessary Guarantor Details

Applying for a Board Exam Loan?

- If you're already a graduate, we'll need a proof of graduation like Diploma or Transcript of Records.

- If you're not yet a graduate, we'll need a proof of Enrollment and proof of Review Center Registration.

- Proof of Billing must reflect your permanent address

- Water Bill

- Electricity Bill

- Phone Bill

- Internet Bill

- Government Clearance must reflect your permanent address

- Barangay Clearance

- NBI Clearance

- Police Clearance

- A photo of your House - Permanent Residence The house’s exterior must be clearly pictured and not a screenshot taken from Google Maps or Google Street View. If living in a condo/apartment, a picture of the building taken outside may be submitted

- Contact Person - we'll need you to provide details of a contact person different from your guarantor

- Must be at least 18 years old

- Does not have an active loan with InvestEd

- Submit Contact Information - valid and working mobile number and email address

- Identification - at least one of the following is accepted:

- Company ID

- Primary or Secondary Government ID

- Government Clearance

- Contact person's selfie with the chosen identification

at least one of the following is accepted and must be within the last 3 months:

at least one of the following is accepted, and it must be unexpired:

Additional Requirements specific for Loan Release or Disbursement

- Tuition Loan

- Submit your school's bank account details or any available payment receiving channels

- Gadget Loan

- If to be purchased through Lazada, submit your verified Lazada Profile

- If to be purchased from other merchants/stores, submit the following details of the merchant:

- Merchant's Contact Person Full Name (e.g. manager, owner, sales rep)

- Merchant's Contact Person's Contact Number

- Merchant's Contact Person's Email Address

- Merchant's Official Business Email Address

- Facebook Page link of the Official Business

- Banking details or any available payment receiving channels

- DTI Registration

- Screenshot of the gadget planned to be purchased also applicable to Lazada applications

- Allowance or Thesis Loan

- Your bank account details or GCash account details

- Breakdown of your monthly expenses

- Rent Loan

- Landlord's Bank account details or GCash account details

- Landlord's Details - Name, Mobile Number, Email Address

- Landlord's Business Permit

- Board Exam Loan

- Review Center's Contact Information - Contact Person’s Name, Mobile Number, Email Address, and Review Center’s Bank Account details or any available payment receiving channels

Note: Your total loan amount can be divided into different type of loans, and it will be released through the corresponding disbursement channels.

Not residing in permanent residence

- Proof of Billing and Government Clearance that reflects current address may be accepted, if the student has been staying at the current address for at least 6 months

My Landlord has no Business Permit

- Proof of Billing or Barangay Clearance under the Landlord’s Name may be accepted

I have no COR/COE/Assessment Form

- Screenshot of School Account Portal may be accepted provided that the pertinent details confirming the student's enrollment status are available

I don’t have my own Bank Account or GCash Account

- A family member or relative’s Bank or GCash Account may be accepted provided that the family member or the relative has the same surname as the student